Author: admin

-

itel takes over with its Premium Color-changing New Smartphone S23

Introducing the itel S23, the smartphone that’s about to revolutionize your style game! This stunning device features a colour-changing rear panel that shifts from mysterious white to dreamy pink when exposed to sunlight or UV rays. It’s like having a fashion accessory that matches your mood! But the S23 isn’t just a pretty face. It’s…

-

Here are ten reasons why you should consider buying the itel P40:

Looking for a smartphone that offers high-end features without breaking the bank? Look no further than the itel P40, the latest addition to itel’s P series of smartphones. Looking for a smartphone that offers high-end features without breaking the bank? Look no further than the itel P40, the latest addition to itel’s P series of…

-

itel Launches the P40 Smartphone in Ghana, Partners with Vodafone to Offer Free 12GB Data Bundle

itel, the globally acclaimed smart life brand, has unveiled its latest 4G smartphone, the itel P40, in Ghana. Known for its commitment to providing affordable smartphones with exceptional performance, itel has once again raised the bar with the P40, offering a range of impressive features and long-lasting power performance such as 600mAH Battery, 64+4 GB…

-

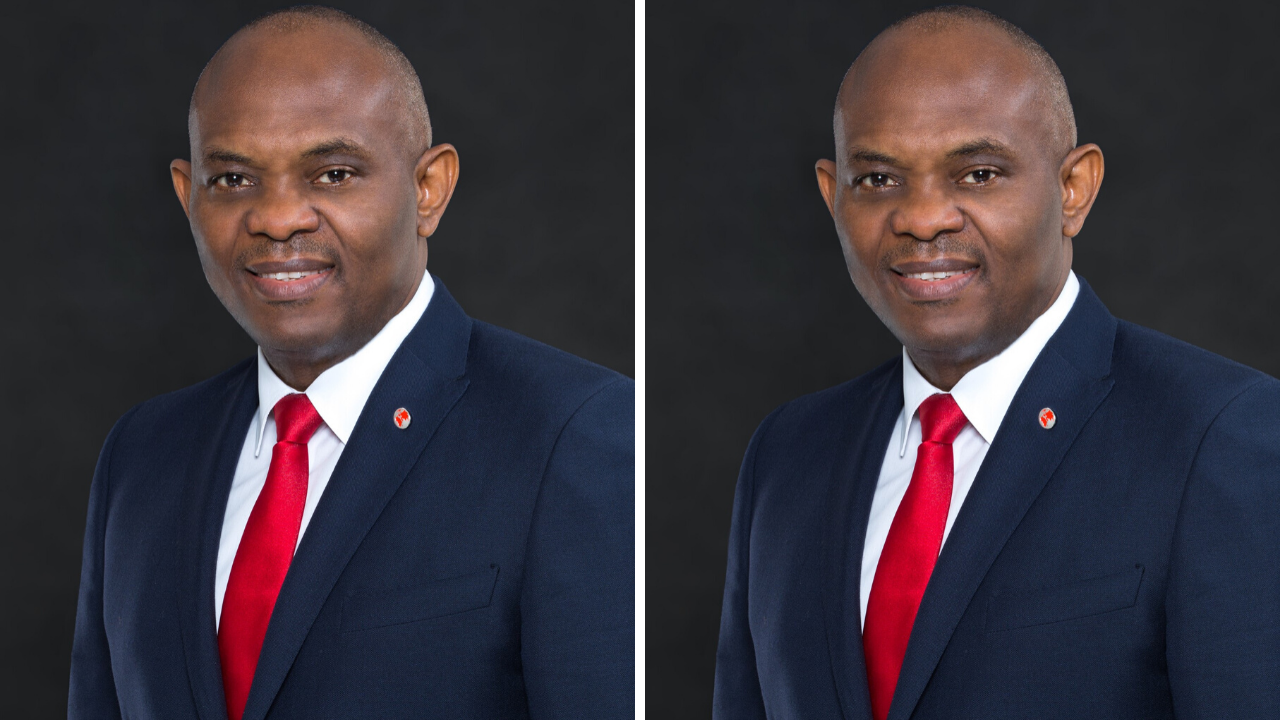

The Time is Now to Invest in Africa and African SMEs, Tony Elumelu Tells Global Investors in Paris

Tony O. Elumelu, Founder of the Tony Elumelu Foundation (TEF) and Chairman, United Bank for Africa (UBA) and Heirs Holdings opened the “Ambition Africa” conference organised by the France Invest Africa Club in Paris, France. As Elumelu delivered the opening address, he urged French investors to look to Africa for long term investment opportunities. The…

-

Tony O. Elumelu Visits Ghana

As conversations continue to ricochet across the African continent about building new, mutually beneficial and effective models of development, Tony O. Elumelu CON, Founder of the Tony Elumelu Foundation, joins Ghanaian President, H.E Nana Akufo Addo and other private and public sector leaders on the Presidential Dialogue themed, Africa’s Money for African Development – A Future Beyond…

-

4 Steps to Boost Your Team’s Morale

A low level of morale for any business is a hindrance and should be tackled directly. If you’ve noticed a low level of morale within your team, that’s the first crucial step to improving the situation. Noticing and acknowledging the problem is better than failing to notice, and you can, therefore, now work to fix…

-

Automation – An Activational Habit for Wealth by Peter Kwadwo Asare Nyarko

Working on my next book titled HABIT FOR WEALTH. The book, HABIT FOR WEALTH will propel you to create wealth and build lasting success, I expounded on habits and wisely elaborate on the concept of forming good habits and breaking bad ones. Habits are the small decisions you make and actions you perform every day.…

-

Living a FRUGAL Lifestyle

Dictionary.com defines the word frugal as: “Economical in use or expenditure; prudent saving or sparing; not wasteful; entailing little expense; requiring few resources.” In short, it basically means that you live a life well within your means.Those who built their wealth over an extended period of time, are often not big spenders but rather tend…

-

Hiring a Digital Marketing Agency vs. DIY

Marketing is essential for the success of every business, big or small. With digital marketing, businesses are able to engage with potentials online and convert them to customers or clients. As a business owner, you have two options when it comes to digital marketing. One, you can do it yourself. Two, you can hire someone…

-

A Poverty Stricken Mindset

As a financial educator and an advocate for sound financial decisions and habits, I have come to realise that most people are suffering from what I called poverty-stricken mindset. Those who are stuck in a poverty-stricken mindset don’t realize or understand the impact that their daily habits are having on their ongoing financial burdens. So…